COMMERCIAL CONSTRUCTION DECLINES AT THE START OF THE YEAR

The latest ‘IHS Markit’s Purchasing Managers’ Index’, reports that commercial building work in the UK has fallen for two consecutive months, ending ten months of expansion. This tailing off in construction output was led by falling demand from businesses, forcing the reduction in civil engineering and commercial property work, negatively impacting the sector.

Economics Associate Director at IHS Markit, Tim Moore commented on the findings: “The UK construction sector moved into decline during February as Brexit anxiety intensified and clients opted to delay decision-making on building projects. Risk aversion in the commercial sub-category has exerted a downward influence on workloads throughout the year so far. This reflects softer business spending on fixed assets such as industrial units, offices and retail space. The fall in commercial work therefore hints at a further slide in domestic business investment during the first quarter, continuing the declines seen in 2018.”

The housing sector was the only category to register construction growth in February. Despite the rate of expansion being modest, due to a general drop in confidence across the housing market, this was the thirteenth consecutive month of growth for residential work.

UK COMMERCIAL INVESTMENT VOLUMES FALTER BUT REMAIN ABOVE THE THREE-YEAR AVERAGE

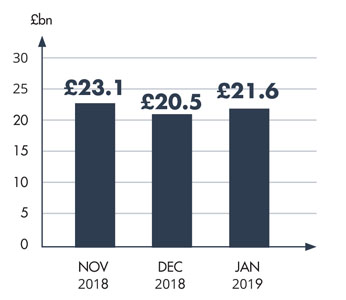

Savills’ recent ‘Market in Minutes’ review of UK commercial property, reveals that investment volumes reached £62.1bn in 2018, a decline of almost 6% (5.7%) year on year. Despite the decline, this does represent a rise on the three-year rolling average of £59.8bn. Considering the combination of ongoing political uncertainty and cooling of some global economics, Savills comment that this is ‘a strong message the UK real estate remains a liquid and desirable investment.’

Despite the recent raft of positive news about the commercial property industrial sector, the research reveals that both market proportion and volumes declined year on year. This is attributed to the fact the creation of prime stock is dominated by a small number of firms who are holding the property for income, not with the intention of trading. In this scenario, it is challenging to foresee how volumes can advance by the same proportions as occupier demand.

For the third consecutive month, the average prime yield for all sectors was maintained at 4.77%.

LIBERTY DEPARTMENT STORE ON THE MARKET

Liberty London, the retail landmark on Great Marlborough Street, founded by Arthur Lasenby Liberty in 1875, has reportedly been put on the market. Private equity firm BlueGem, purchased the store in 2010 for £32m, refinancing it four years later, reducing its stake to 40%, allowing some investors to withdraw money, but nearly all reinvested in buying the department store for £165m.

It is understood BlueGem is looking to sell its stake and has hired UBS to seek a private buyer. It is not clear at this stage whether other investors are willing to sell.

The property is on the market at a time of upheaval for department stores and retail in general, who are facing intense competition from online retail and contending with high rates. According to the real estate adviser Altus Group, Liberty’s rates bill increased over 16% to more than £1m during the last financial year. |