Business Review January 2019

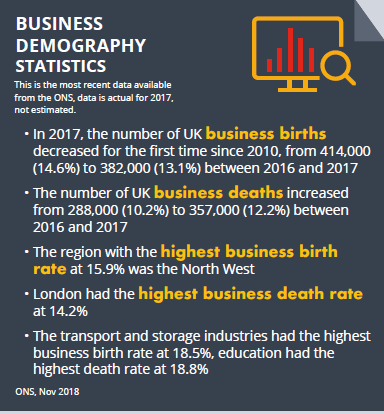

Government called to encourage and support UK small businesses

In its New Year message, the Federation of Small Businesses (FSB) urged the government to re-focus on encouraging and supporting UK small businesses in 2019.

FSB National Chairman, Mike Cherry, commented: “Small business owners tend to be an optimistic bunch. They are used to being nimble, adapting to circumstances and making the most of opportunities. They are creative and entrepreneurial. And yet as we head into 2019, small business confidence is on the floor, and desperately needs lifting.”

Focusing on Brexit, he urged the government to provide clear advice for businesses on how to comply with any new requirements. The message also identified other key issues affecting small businesses this year, including poor payment practices, the pressure on the high streets and legislative changes such as Making Tax Digital for VAT.

Auto-enrolment April 2019 increase

The number of auto-enrolment fines increased 144% in 2017-18. Analysis of data from the Pensions Regulator shows that businesses were fined £42m in 2017-18 for auto-enrolment errors, up from £12.6m in 2016-17. The increase coincides with the extension of auto-enrolment duties to include smaller businesses with fewer than 50 employees.

Smaller companies without in-house HR functions are particularly vulnerable to making errors. Smaller businesses can be fined for something as simple as failing to provide regular salary updates and data submissions on employees, this will be regarded as non-compliance and will result in fines.

The minimum contributions you and your staff pay into your automatic-enrolment workplace pension scheme will increase from 6 April 2019. The total minimum contribution will increase from 5% (2% employer / 3% staff contribution) to 8% (3% employer / 5% staff contribution).

40% of firms ‘unaware of Making Tax Digital for VAT’

In its first step in the reform of the UK’s tax system, on 1 April 2019, the government intends to mandate Making Tax Digital for VAT (MTD for VAT) for all businesses with taxable turnover of over £85,000. As part of the initiative, firms must keep some records digitally, and must submit their VAT returns via an Application Programming Interface (API).

It is widely anticipated many businesses will not be ready for MTD for VAT, with as many as 40% of affected businesses not even aware of it, let alone prepared for a substantial change to their accounting processes.

With limited information available to firms, the Low Incomes Tax Reform Group (LITRG) has called for HMRC to publish detailed exemption guidance. HMRC has suggested that people contact the VAT helpline to speak to an adviser if they think they should be exempt.

The House of Lords Economic Affairs Committee have recommended that the government defer the introduction by at least one year, while encouraging businesses to join voluntarily and publish its plan for the long-term development of Making Tax Digital, to encourage businesses to choose digitalisation for productivity, efficiency and modernisation reasons rather than just tax compliance.

Top rated employee perks

According to a recent study conducted by paymentsense, 38% of employees would consider switching jobs to improve their work benefits. It’s interesting to see how efforts to retain and motivate your workforce have progressed over the years, from annual Christmas do’s to free tea and coffee.

With work-life balance a priority for many, the study revealed that when questioned about the most desirable perk, 35% of respondents agreed that unlimited holiday and early finish Fridays were top requirements. Whilst the prospect may seem like a headache for businesses, the study concluded that some staff would be willing to sacrifice a portion of their salary for these benefits.

Whilst some larger companies have introduced a six-hour working day with the intention of increasing efficiency and boost motivation, others have started to offer more quirky perks, such as paid time off for new pet owners (aptly referred to as ‘furternity or ‘pawternity’ leave), or ‘game breaks’ to help employees letting off steam playing foosball or wall climbing in on-site games rooms. Student loan repayment schemes are particularly popular with young recruits.

The complexity of minimum wage rules to be addressed

Minimum wage technical breaches have landed several larger companies in trouble of late, including Iceland Foods, who are facing a £21 million HMRC bill. As a result, Business Secretary, Greg Clark has promised to review national minimum wage regulations that “unnecessarily burden and penalise” employers.

In a letter to the British Retail Consortium, Greg Clark informed retailers that he had been considering claims that minimum wage rules could be “overly complex” and requested further evidence of the problem. Reform will be considered “when evidence shows that rules unnecessarily penalise employers, and that changing them will not reduce the protection offered to low-paid workers.”

Areas identified for reform are salary sacrifice schemes and where companies have encountered problems in relation to deductions for uniforms, particularly when deductions take an employee pay below the national minimum wage. Where deductions are considered to be for the employers’ own use or benefit, as they largely have for cases relating to uniforms, then the deductions will be regarded as reducing the employees’ pay, potentially below the national minimum wage, placing the employer in breach.

Salary sacrifice schemes are a more contentious area as it is difficult to determine whether the deductions are for the employer’s own use or benefit. Clarity is required.

Industry leaders have said it is essential that the rules are updated to reflect modern work practices. Ministers launched a consultation prior to Christmas.

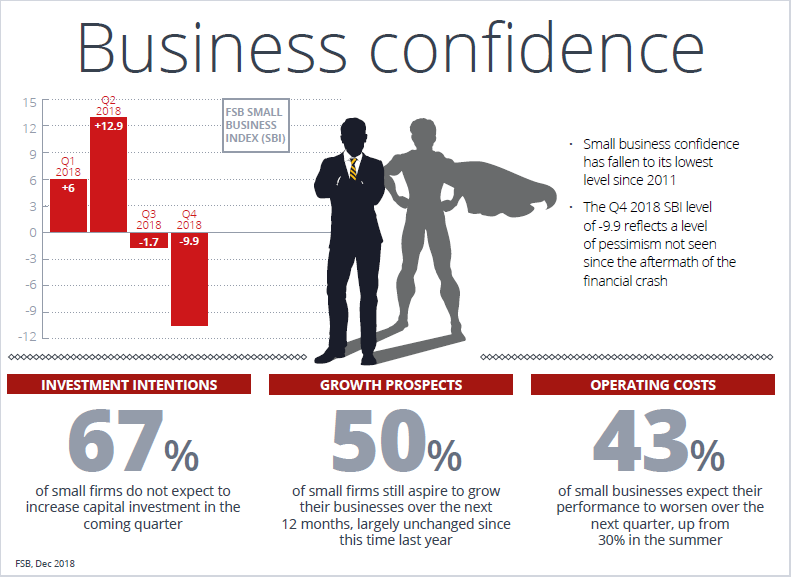

UK firms feeling the squeeze

The most recent Quarterly Economic Survey from the BCC (British Chambers of Commerce) has revealed that as a result of heightened Brexit uncertainty and other economic pressures, the UK economy ended 2018 stuck in a weak holding pattern, with stagnating levels of growth and business confidence. Consumer-facing firms are particularly downbeat, as a result of subdued household spending levels and tightening cashflow.

Firms are being squeezed by rising prices and a slowdown in domestic sales, in addition the number of companies finding it difficult to recruit staff stands near record highs – a staggering 81% of employers in the manufacturing sector have reported difficulties in finding the right workers, representing the joint highest level since records began in 1989. In the services sector, the level (70%) hovers close to the record high recorded in the previous quarter (72%).

The number of manufacturers expecting to increase prices is at its highest level in a year, nearly three times higher than its pre-EU referendum average.

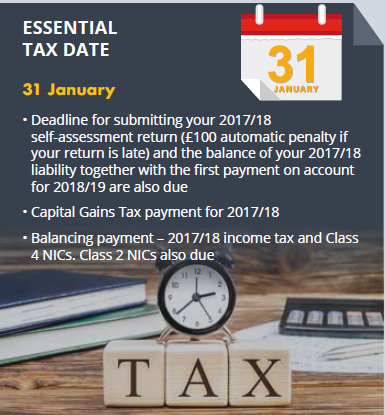

Class 2 national insurance contributions – a reminder

In the autumn, the government abandoned its plans to abolish Class 2 national insurance contributions (NICs), paid by self-employed people with profits of £6,205 or more a year. They were originally due to be abolished in April 2018, but the plans were delayed for a year until April 2019. The government announced that Class 2 NICs will not be abolished during this Parliament. The move was expected to save millions of workers around £150 a year. Concerns had been aired that that abolition would hit more than 300,000 self-employed people earning less than £6,000 a year, who were paying Class 2 NICs voluntarily, in order to access the state pension.

Robert Jenrick, Exchequer Secretary to the Treasury, stated that eliminating Class 2 NICs would have introduced greater complexity to the UK tax system: “The government remains committed to simplifying the tax system for the self-employed and will keep this issue under review in the context of the wider tax system and the sustainability of the public finances”.

Other news

Poor broadband holds back productivity

The FSB has warned that productivity among some UK small businesses is being hindered by poor broadband and mobile coverage. The warning comes in response to Ofcom’s annual Connected Nations report, which revealed that, only 90% of small businesses can access superfast speeds, and just 41% of rural businesses receive 4G coverage.

Rising energy costs hit small businesses

With the average UK energy bill for small businesses totalling around £3,000 per year, and rising, top of your financial resolutions list may be looking at ways to reduce this hefty expense. Despite the initial outlay, switching from computers to laptops could help, as laptops consume 80% less electricity than PCs.

Childcare fees risen faster than wages

A recent TUC report has revealed that childcare fees have risen by 52% since 2008, while wages have risen by just 17% in the same period. Average childcare fees in England have risen from £159pw in 2008 to £236 in 2018 for a child aged under two; and for children over two, they have risen from £149pw to £232 in that ten-year period.

Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored advice and is for information purposes only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on individual circumstances. No part of this document may be reproduced in any manner without prior permission.